Kefi Gold and Copper Plc (LSE: KEFI) is a gold and copper exploration and development company focused on projects in Ethiopia and Saudi Arabia. The company’s share price has been a subject of interest for investors, with fluctuations influenced by various factors. This article aims to provide a comprehensive overview of Kefi’s share price, covering its historical performance, current trends, and potential future prospects.

Understanding Kefi Gold and Copper Plc

Kefi Gold and Copper Plc is a publicly traded company listed on the London Stock Exchange. The company’s primary focus is on the development of two significant projects:

Tulu Kapi Gold Project, Ethiopia: This project is nearing completion and is expected to commence gold production in the near future.

Hawiah Gold Project, Saudi Arabia: This project is in the exploration and development phase, with potential for substantial gold reserves.

Kefi Gold and Copper Share Price: Historical Performance

Kefi’s share price has experienced significant fluctuations over the years, reflecting the inherent volatility of the mining sector and the company’s progress in developing its projects.

Key Factors Influencing Kefi’s Share Price

Several factors can influence Kefi’s share price, including:

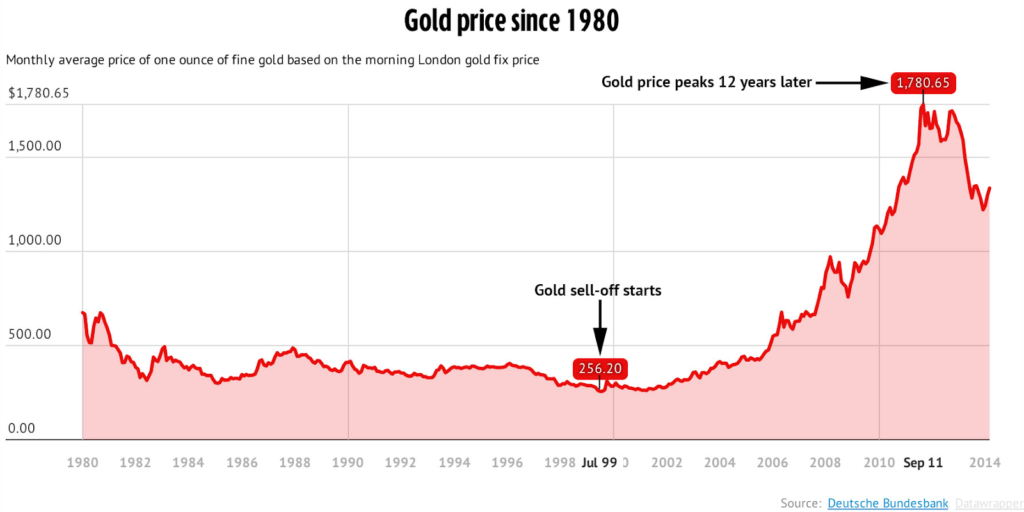

Gold Price: As a gold mining company, Kefi’s fortunes are closely tied to the global gold price. When gold prices rise, Kefi’s shares tend to appreciate, and vice versa.

Project Development Progress: Significant milestones in the development of Tulu Kapi and Hawiah projects, such as construction updates, resource estimates, and feasibility studies, can have a substantial impact on investor sentiment and share price.

Commodity Market Trends: The overall performance of the commodity market, including copper prices, can also influence investor interest in Kefi.

Industry News and Events: Global economic conditions, geopolitical events, and industry-specific news can create volatility in the mining sector, affecting Kefi’s share price.

Investor Sentiment: Market sentiment and investor expectations play a crucial role in driving share price movements. Positive news and optimistic forecasts can lead to a rise in share price, while negative news or concerns can trigger a decline.

Analyzing Kefi’s Share Price: A Technical Perspective

In order to spot trends and forecast future price movements, technical analysis looks at historical price and volume data. Investors use various technical indicators, such as moving averages, relative strength index (RSI), and MACD, to analyze Kefi’s share price trends.

Fundamental Analysis of Kefi’s Share Price

Fundamental analysis focuses on evaluating a company’s intrinsic value based on its financial performance, assets, and future prospects. Investors analyze Kefi’s financial statements, including revenue, earnings, cash flow, and debt levels, to assess its financial health and growth potential.

Kefi’s Share Price: Future Outlook

Kefi’s future share price will depend on several factors, including:

Successful Commissioning of Tulu Kapi: The successful commissioning and ramp-up of gold production at Tulu Kapi will be a significant catalyst for Kefi’s share price.

Exploration Success at Hawiah: Further exploration and resource upgrades at Hawiah could unlock significant value for the company.

Gold Price Outlook: The long-term outlook for gold prices will play a crucial role in determining Kefi’s profitability and share price.

Market Conditions: Global economic conditions, geopolitical events, and investor sentiment will continue to influence Kefi’s share price.

Investing in Kefi Gold and Copper

Investors interested in Kefi should conduct thorough research and consider the following factors:

Risk Tolerance: Investing in mining companies carries inherent risks, including commodity price volatility, geopolitical risks, and project development uncertainties.

Investment Horizon: Kefi’s projects are in different stages of development, and investors should have a long-term investment horizon to potentially benefit from the company’s growth.

Diversification: Diversifying your investment portfolio across different sectors and asset classes can help mitigate risks associated with investing in Kefi.

Financial Health: Analyzing Kefi’s financial statements and assessing its debt levels can provide insights into the company’s financial health and future prospects.

FAQs

What factors influence the KEFI Gold and Copper share price?

The share price of KEFI Gold and Copper is influenced by a variety of factors, both internal and external. Internal factors include the company’s financial performance, exploration and development progress at its projects, and management decisions. External factors include the overall market sentiment, commodity prices (particularly gold and copper), geopolitical risks, and regulatory changes. For example, positive news about project development, successful exploration results, or rising gold and copper prices can lead to an increase in the share price. Conversely, negative news about project delays, declining commodity prices, or increased geopolitical risks can negatively impact the share price.

What is the current share price of KEFI Gold and Copper?

The current share price of KEFI Gold and Copper can be found on various financial data providers, such as the London Stock Exchange (LSE) website or through financial news platforms. It’s important to note that share prices fluctuate constantly due to market activity and the factors mentioned above.

What is the historical performance of the KEFI Gold and Copper share price?

The historical performance of KEFI Gold and Copper’s share price can be analyzed by looking at its past price trends, which can be found on financial data providers. This analysis can help investors understand the company’s past performance and identify potential patterns or trends. However, past performance is not necessarily indicative of future results, and investors should conduct thorough research and consider various factors before making investment decisions.

What are the growth prospects for KEFI Gold and Copper?

The growth prospects for KEFI Gold and Copper depend on several factors, including the successful development and operation of its projects, the performance of the gold and copper markets, and the company’s ability to manage risks effectively. Positive factors such as successful project development, rising commodity prices, and strong management can contribute to positive growth prospects. However, negative factors such as project delays, declining commodity prices, and operational challenges can hinder growth. Before making an investment, investors should carefully weigh these considerations and carry out in-depth research.

In summary:

Kefi Gold and Copper Plc is a mining company with significant potential, but its share price is subject to market volatility and various factors. Investors interested in Kefi should conduct thorough research, understand the risks involved, and have a long-term investment horizon. By closely monitoring the company’s progress, gold price trends, and market conditions, investors can make informed decisions about investing in Kefi.

To read more, Click here