British Land, a leading real estate investment trust (REIT) in the United Kingdom, has been a prominent player in the property market for decades. Understanding the dynamics of its share price is crucial for investors seeking to capitalize on opportunities within the real estate sector. This article provides a comprehensive analysis of British Land’s share price, covering its historical performance, key factors influencing its fluctuations, and potential future trends.

Historical Performance

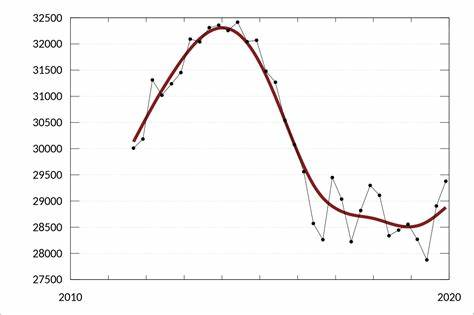

British Land’s share price has exhibited a mixed performance over the years, influenced by various economic factors, market sentiment, and company-specific events. To gain a better understanding of its historical trajectory, let’s examine some key periods:

The Global Financial Crisis: Like many other real estate companies, British Land faced significant challenges during the global financial crisis of 2008. Its share price plummeted as the property market experienced a severe downturn. However, the company managed to navigate the crisis through strategic asset sales and cost-cutting measures.

Post-Crisis Recovery: Following the financial crisis, British Land’s share price gradually recovered as the UK economy stabilized and the real estate market began to rebound. The company’s focus on high-quality assets and its ability to adapt to changing market conditions contributed to its resilience.

Recent Trends: In recent years, British Land’s share price has been influenced by factors such as Brexit, the COVID-19 pandemic, and broader economic trends. While the pandemic presented significant challenges for the retail sector, British Land’s diversified portfolio, including office and residential properties, helped mitigate the impact.

Key Factors Influencing British Land’s Share Price

Several factors can significantly influence British Land’s share price, including:

Economic Indicators: Macroeconomic factors such as GDP growth, interest rates, and inflation play a crucial role in determining the overall health of the real estate market. A strong economy with low interest rates generally favors real estate investment, including British Land’s shares.

Property Market Trends: The performance of the UK property market, particularly in key sectors like office, retail, and residential, directly impacts British Land’s business and, consequently, its share price. Changes in rental yields, occupancy rates, and property values can drive fluctuations in the company’s stock.

Company Performance: British Land’s financial performance, including revenue growth, profit margins, and dividend payouts, is a key driver of its share price. Investors closely monitor the company’s ability to generate consistent returns and maintain a healthy balance sheet.

Investor Sentiment: Market sentiment towards British Land and the broader real estate sector can significantly impact its share price. Positive news and favorable analyst ratings can boost investor confidence, leading to increased demand for the company’s shares. Conversely, negative sentiment or concerns about the company’s future prospects can put downward pressure on the share price.

Potential Future Trends

Predicting the future direction of British Land’s share price is challenging, as it depends on a multitude of factors. However, based on current trends and industry analysis, several potential scenarios can be considered:

Continued Recovery: If the UK economy continues to recover from the pandemic and the property market remains resilient, British Land’s share price could see further upward momentum. The company’s focus on high-quality assets and its ability to adapt to changing market conditions could drive its growth.

Increased Volatility: The ongoing uncertainty surrounding Brexit, geopolitical risks, and potential economic downturns could lead to increased volatility in British Land’s share price. Investors may need to exercise caution and carefully consider their risk tolerance.

Dividend Growth: British Land has a history of paying consistent dividends to its shareholders. If the company continues to generate strong cash flows, it may be able to increase its dividend payouts, which could attract income-seeking investors.

FAQs

What is British Land?

British Land is a leading UK commercial property company that owns, manages, and develops some of the most iconic properties in the country. The company has a diverse portfolio of properties, including offices, retail spaces, and residential developments. British Land is known for its focus on sustainability and its commitment to creating vibrant, sustainable communities.

How does the share price of British Land fluctuate?

.

The share price of British Land can fluctuate for a variety of reasons, including:

Economic factors: The overall health of the UK economy can have a significant impact on the share price of British Land. Factors such as interest rates, inflation, and GDP growth can all affect the demand for commercial property.

Industry trends: Changes in the commercial property market, such as shifts in demand for office space or retail space, can also impact the share price of British Land.

Company performance: The financial performance of British Land, including its revenue, profits, and dividend payments, can also influence the share price. Investors closely monitor the company’s performance to assess its future prospects.

Global events: Global events, such as political instability or natural disasters, can also affect the share price of British Land. These events can create uncertainty and impact investor sentiment.

What are the factors that drive the demand for British Land shares?

The demand for British Land shares is driven by a variety of factors, including:

Dividend yield: British Land is known for its attractive dividend yield, which can be a major draw for income-seeking investors.

Property portfolio: The quality and diversity of British Land’s property portfolio can also influence investor demand. Investors are attracted to companies with a strong track record of generating rental income and capital appreciation.

Growth prospects: The growth prospects of British Land, both in terms of its existing properties and its development pipeline, can also be a factor in investor demand.

Sustainability focus: British Land’s commitment to sustainability can be a positive factor for investors who prioritize environmentally responsible investments.

What are the risks associated with investing in British Land shares?

Investing in British Land shares, like any investment, involves risks. Some of the key risks include:

Market volatility: The share price of British Land can be subject to significant fluctuations, which can lead to losses for investors.

Economic uncertainty: The UK economy is subject to various uncertainties, which can impact the demand for commercial property and, in turn, the share price of British Land.

Competition: British Land faces competition from other commercial property companies, which can impact its profitability and market share.

Regulatory risks: Changes in government policies or regulations could have a negative impact on British Land’s business..

British Land’s share price is influenced by a complex interplay of economic factors, market trends, and company-specific performance. While the future is uncertain, understanding the key drivers of its stock price can help investors make informed decisions. By carefully analyzing historical performance, considering current market conditions, and assessing potential future trends, investors can develop a well-informed strategy for investing in British Land.

To read more, Click here